This is the same as the probability of the option expiring worthless. If you set the upper slider bar to 145, it would equal 1 minus the probability of the option expiring above the upper slider bar (1 –. Probability of the option expiring below the upper slider bar.In addition, you can easily make the following calculations, which many option traders find useful (see Figure 4): Expiring”).įigure 3. Using a specific option price and profit and loss amount to calculate probability Touching”) as well as the probability of the option reaching that price level at expiration (“Prob. As shown in the purple circle in Figure 3, this will calculate the probability of the option reaching that price at any time between now and expiration (“Prob. To forecast the probabilities of the underlying stock reaching a different price on the various dates displayed, you would place your cursor anywhere on the chart and hold down the left mouse button to create crosshairs that pinpoint the forecasted price and profit and loss amount.

#Potential stock profit calculator update

You can click the Refresh button at any time to update the pricing inputs. In this example, the 145 calls are out of the money initially, so notice how the loss increases as time elapses toward expiration this is due to time-value erosion. In Figure 2, the profit and loss calculations (shown in the blue box) for the date of entry (orange line), the half-way point (blue line), and expiration (purple line) are estimated, assuming the price of the underlying stock remains unchanged from its current level. These probability calculations will change if you alter the lower and upper targets by either moving the slider bars with your mouse or by typing in specific values for the lower target and upper target. Assuming the two settings above, this would equal 1 minus the sum of the two previous calculations (1 – (.4756 +.

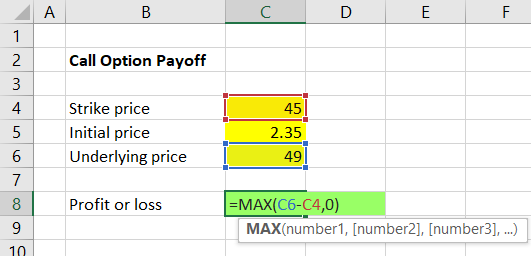

Now, if you select the Trade & Probability Calculator tab, you’ll see the following additional calculations are done automatically and displayed graphically (shown in the green box in Figure 2): These values are also automatically calculated for many other option strategies although the formulas are different. The maximum gain for long calls is theoretically unlimited regardless of the option premium paid, but the maximum loss and breakeven will change relative to the price you pay for the option. Breakeven (BE) = strike price + option premium (145 + 3.50) = $148.50 (assuming held to expiration).The following price calculations (shown in the purple box) are done automatically: Suppose you’re considering the purchase of 1 IBM 145 Call at a price of $ 3.50 when the price of IBM is $140.92 (see Figure 2). For example, you can edit the default implied volatility, dividend yield, and interest rate settings to see how this might affect the outcomes, both numerically and graphically.įollow this example of how the Trade & Probability Calculator works in action: All option pricing inputs can be changed, which allows you to view the price levels and probabilities that are most important to you.

0 kommentar(er)

0 kommentar(er)